Tax Season Marketing: 5 Tips to Help Your Business Grow

Tax season is a time of year that you can almost guarantee that everyone is checking their mailboxes regularly. Many people are anxiously awaiting the arrival of their W-2 forms in the mail so they can start filing their taxes. Since everyone is paying close attention to their mail during tax time, it is the perfect opportunity to focus your tax season marketing efforts more heavily on direct mail. Below are 5 tips to get the most out of your marketing efforts during tax time.

1. Change Your Tactics Each Month

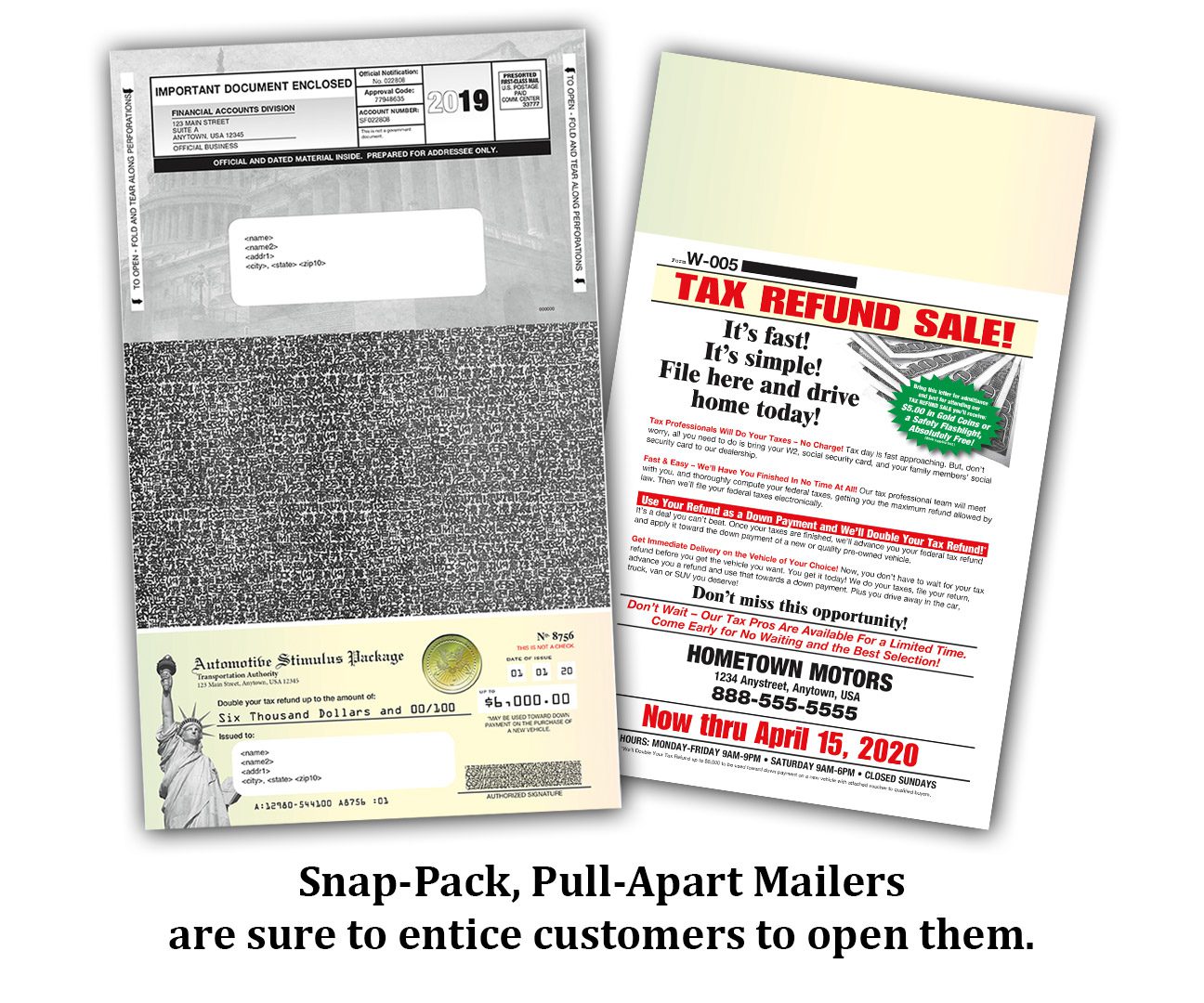

When referring to tax season, you can mean anywhere from January to April. Since this covers such a long stretch, it is important to realize how you should be marketing your business during each month of this season. January is the month in which most people start receiving their W-2s. During January, and even early February, a tactic you could use is to send your customers a piece of direct mail that may remind them of a tax form. Get them to open your tax time mail by thinking it is a tax form, but get them to continue reading by offering an amazing value.

By mid-February and through March, people will have started receiving tax refunds. This is when you should focus heavily on promotions dealing with tax refunds. People will also have a bit more money than usual, so bumping up your tax season marketing efforts in general during this time just makes sense.

2. Use Tax Season Marketing Numbers and Phrases

You can take almost any promotion that you run regularly and market it as a “Tax Season Sale.” An easy way to do this is to incorporate some of the lingo that people recognize as being associated with taxes. Make use of the phrase “EZ.” Offer prices of $10.40 for items to touch back to the 1040 form that no one wants to fill out. April 15th is a date that most people are familiar with. Run a sale with the expiration date of April 15th, and it will stick in people’s minds more easily. When assigning promo codes, think of key words like “1040M” or “TAXSAVINGS.”

3. Offer Tax Filing Services

A strategy that will be sure to get people through the door is to offer tax filing services at your location. Either offer the service yourself, or partner up with a well-known tax professional. People have to file their taxes anyway, why not with you? Use incentives such as doubling their refund amount towards a purchase at your business. This is especially helpful for large purchases such as cars, houses, and vacations. Car dealerships can benefit greatly from tax season marketing by using these strategies.

4. Why Should Customers Spend Their Refund WITH YOU?

By February and March, customers who are getting a tax refund will start receiving them. Odds are, they are looking for ways to spend this large sum of money they just came upon. Entice customers to spend their tax refund with your business. If you run an automotive business, offer to match their refund for a down payment. Offer tax-themed sales to promote new electronics. Or you can go for a different approach, and run a “no sales tax” promotion to entice those customers who may have had to just pay in a bunch of owed taxes.

5. Ease the Stress of Tax Time

April 15th is the tax deadline. Just because the stress of tax season is finally over, doesn’t mean your tax season marketing has to be. Offer ways to relax customers at the end of this hectic season. April would be a great time for a spa, massage studio, or salon to run a special promoting “de-stressing after tax time.” You can also offer a gift card to these types of businesses as an incentive for customers to spend their money with your business. Running a Vacation Giveaway Raffle is another great idea.

PrimeNet would love to help you with your tax season marketing efforts. Contact us today at 1-800-826-2869 to get started!

For physical samples of our work, click the “Request Samples” button below. To view more of our sample work online, click here.

(Clicking the “Request Samples” image should open your default email client.

If it does not, please use the contact form.)